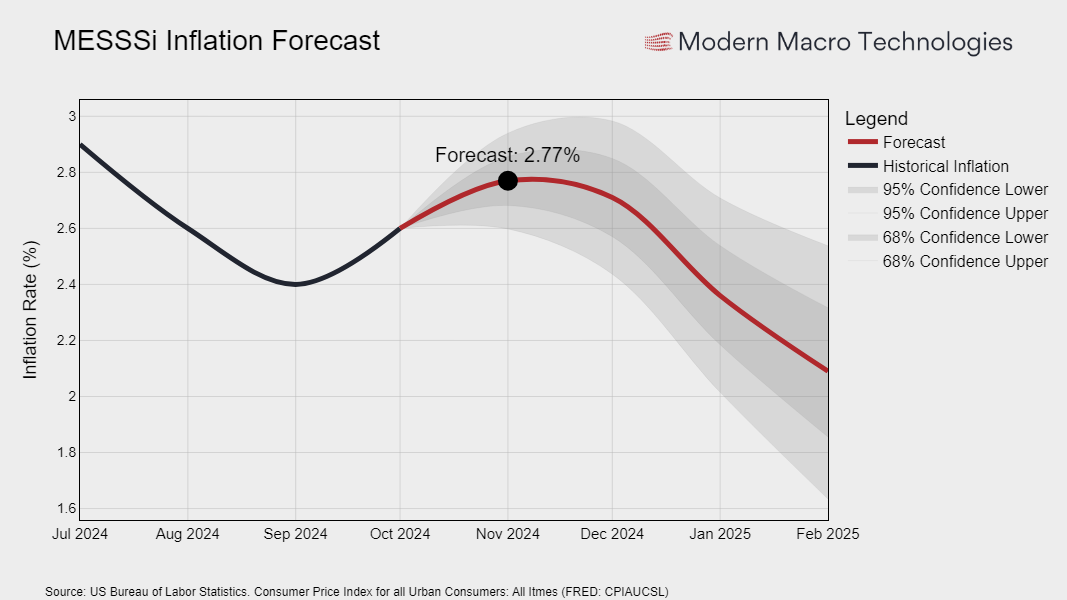

MESSSi Inflation Forecast: Hot then Drop

CPI for October came in at 2.6% today, inline with forecasts but persistant inflation remains a key narrative as we finish out the year. Today's 2.6% print aligns closely with projections from the MESSSi model and we anticipate elevated CPI readings through November and December, with modest reductions expected to emerge in early 2025.

The Fed’s recent rate cut on November 7 has been incorporated into the model. After a two-day meeting, the Federal Open Market Committee noted that “economic activity has continued to expand at a solid pace.” The committee lowered the target rate range to 4.50% to 4.75%, as anticipated, with a unanimous decision.

Expectations of another 25-basis-point rate cut on December 18 have also been factored into our model. These projections, derived from the 30-Day Fed Funds futures, currently reflect a 63% probability of a target range of 4.24% to 4.50% for the upcoming decision.

Although Donald Trump’s recent election victory may influence the macroeconomy and inflation over the coming two years, there appears to be no immediate effect on inflation forecasts extending to March 2025.